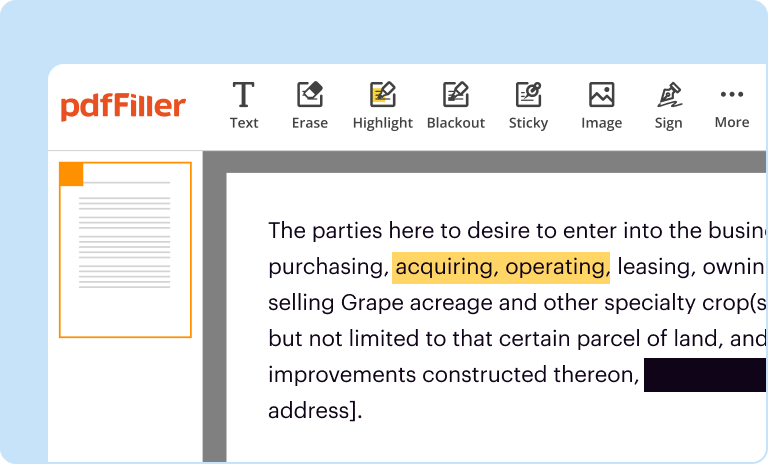

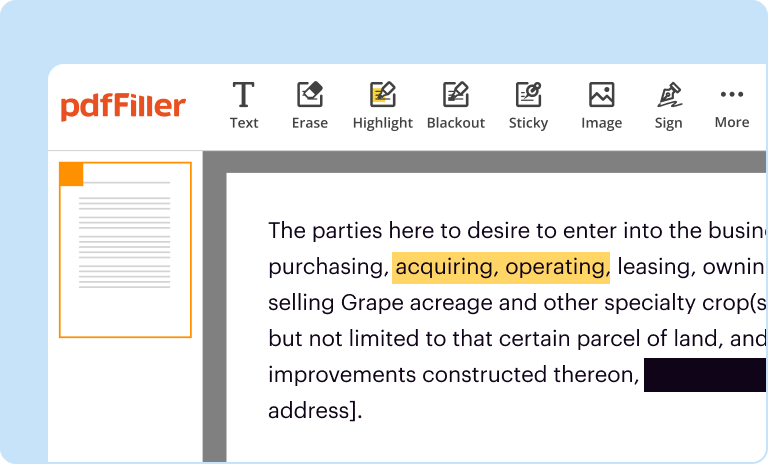

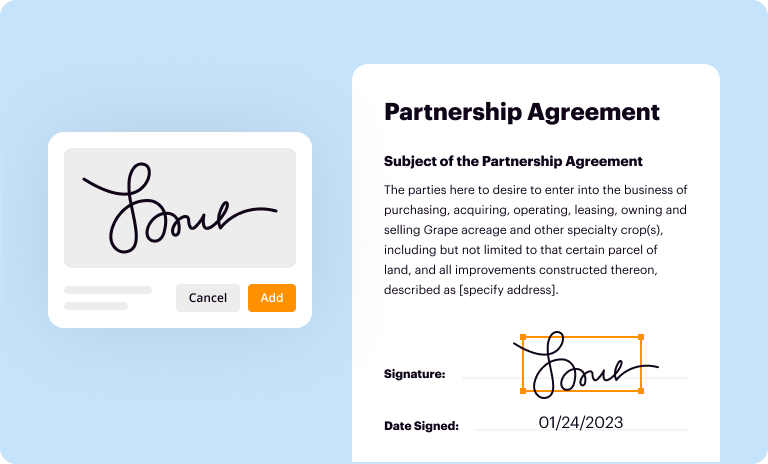

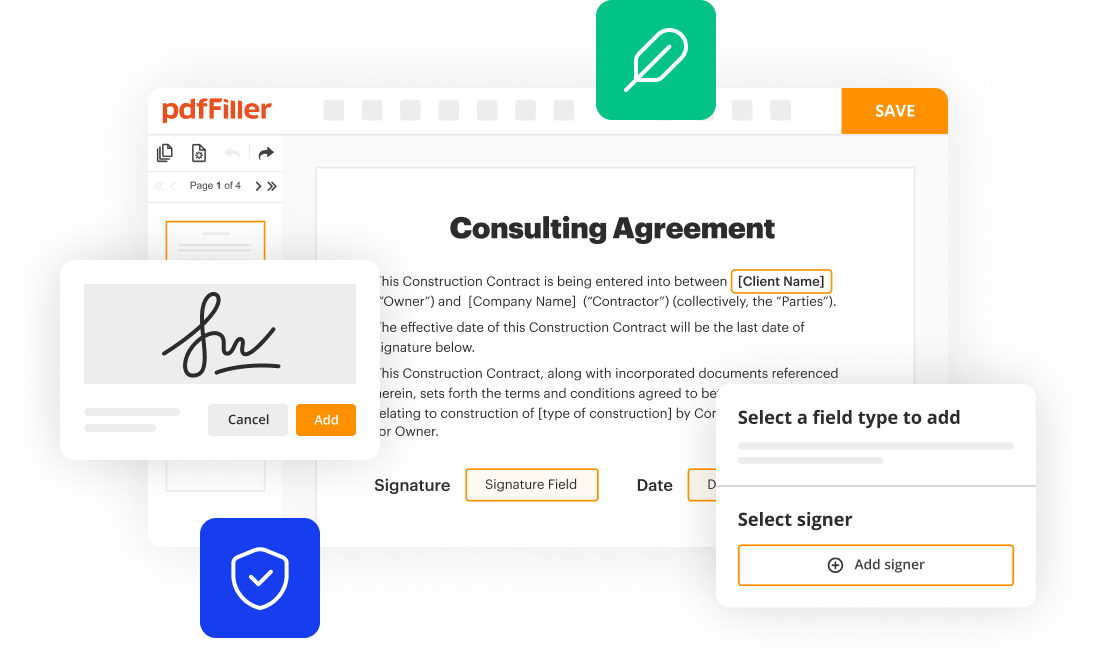

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

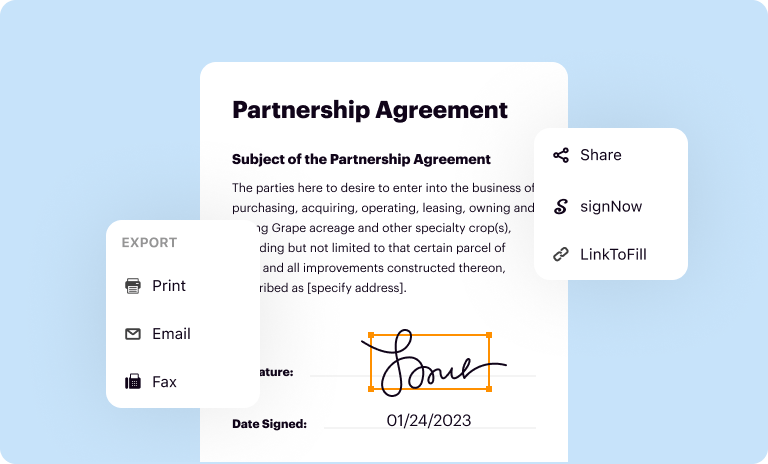

Email, fax, or share your non borrower contribution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

Edit non borrower contribution form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Clearly state the purpose of the letter, which is to explain and document any monetary contributions towards the mortgage.

Provide detailed information about each contribution, including the date, amount, and source of funds.

Include any supporting documents or evidence of the contributions, such as bank statements, gift letters, or cashier's checks.

Clearly indicate the relationship between the contributor and the borrower, especially if the contribution is a gift.

If the contribution is a loan, specify the terms of repayment and any interest rates involved.Be honest and accurate in providing information, as any false or misleading statements can have legal consequences.

Sign the letter and include contact information in case any further clarification or documentation is needed.

Keep a copy of the letter and all supporting documents for your records.Individuals or couples who are applying for a mortgage loan and have received financial contributions from friends, family members, or other sources.

Borrowers who are using monetary gifts or loans to meet the down payment or closing costs requirements of their mortgage.

Anyone seeking to provide documentation and evidence of the funds used towards the purchase of a home to satisfy the lender's requirements.

This form is called a borrower certification and authorization in this form is part of your mortgage application that you would complete when you apply for a mortgage companies Equuleus mortgage LLC and my name is Jeremy Randy's I am a certified mortgage planning specialist and also a certified residential mortgage specialist the borrow authorization certification this part just saying basically the information that you provide to us is true and accurate to the best of your knowledge and also this form authorizes us to go ahead and request or verify information like employment your assets income etc anything that's pertinent to the application you give us the authorization to verify going to add to the middle of the form mortgage fraud prevention that's just stating that mortgage fraud willfully not disclosing or disclosing fraudulent information it is a crime, and it could be punishable in fines or jail time go down to the bottom of the form it also stays an affidavit of occupancy if you're saying that the problem the residence is going to be a primary residence testing well then you must occupy within 30 days of closing if you say, and it's a secondary residence you have to occupy it at least 15 days of the year and that down here if it's an investment property then you're just saying you're purchasing it to be either hell or rented out as an investment disclosure at the bottom of this form I will get into that in additional videos one by one on YouTube, so you could view it at your leisure for information and the more information you have the better decision you can make regarding your mortgage you should know exactly what you're what you're doing and how to properly invest in real estate the bottom here is where the borrower sign and date and the Cobra on a date this is Justin disclosure and that's not a contract it's just saying that it has to be disclosed to you, and you have to sign it, so we could verify the information and request additional documents if we eat it now our company is equalized mortgage LLC and this is my name Jeremy rammed us I'm a certified mortgage planning specialist and the certified residential mortgage specialist and also a general Mortgage Association associate these are higher level of training that I have acquired and certification that I have received upon completion of those training in order to better serve you in a more professional efficient way here's our address my phone my direct line my website address and my email if you should have any questions regarding mortgages or mortgage planning please contact me this is my number and my email address thank you